If banks are from mars, then cryptocurrency and blockchain are from venus

Article highlights

- Increasing institutional interest: The majority of institutional investors expect to buy or invest in digital assets in the future, with increasing adoption rates in Asia, Europe, and the U.S. However, concerns about regulation and risk/volatility are still barriers for those not currently investing in crypto.

- Implementation and convergence: The traditional financial industry is starting to implement digital assets and blockchain technology. Wall Street banks are opening digital asset divisions, and there is a growing integration between traditional finance and decentralised finance.

- Transformational potential: Banks and regulated financial services firms have recognised the transformational potential of crypto and blockchain technology.

The era of convergence has arrived

This has largely been the status quo for over a decade since the birth of the Bitcoin network in 2008. However, could the planets now be aligning themselves as a convergence between traditional finance (TradFi) and decentralised finance (DeFi) becomes a reality? Of course, there have been sporadic forays by banks and institutional investors into the world of crypto and blockchain before now. Tokenistic (no pun intended) as some banks’ previous announcements may have been, there have certainly been some innovators and early adopters into the space. Some of the first venturers into the industry joined blockchain banking consortia, such as R3 as far back as 2015. But now a divide is really starting to open up between those banks and financial institutions who have seriously understood that digital assets are here to stay and the traditionalists who remain stubbornly on the fence or are still outright sceptical.

THE TIMES, THEY ARE A CHANGIN’

Looking at some past media headlines for comparison shows how far the landscape has shifted. In 2017, we saw the media reporting “Bitcoin’s real value could be zero, Morgan Stanley analyst says”. Fast forward to 2021, when “Morgan Stanley becomes the first US bank to offer its wealthy clients access to Bitcoin funds”. In 2017, JP Morgan CEO, Jamie Dimon, was famously sceptical about bitcoin, calling it a ‘fraud’ that will eventually blow up. By 2021, JP Morgan not only has its own cryptocurrency, but 382 banks are using its blockchain-based link platform to exchange data, and the bank is even encouraging investors to allocate a portion of their portfolios to bitcoin. Nowadays, Goldman Sachs is also one of the leading investors in Circle’s stablecoin USDC. And as recently as last month, Cointelegraph was reporting that multinational investment bank, JPMorgan Chase & Co, is trialling the use of its own private blockchain for collateral settlements. Media headlines are, of course, just a barometer for what is happening in the markets. So, what do institutional investors actually say when asked about this topic directly?

BEYOND THE HEADLINES – HOW DO INSTITUTIONAL INVESTORS REALLY VIEW DIGITAL ASSETS?

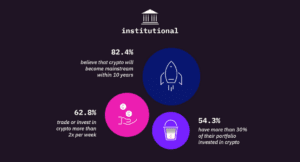

Last year, Fidelity Digital Assets published a significant report into the subject. The Institutional Investor Digital Assets Study found that as many as seven in ten institutional investors expect to buy or invest in digital assets in the future, and more than 90% of those interested in digital assets expect to have an allocation in their institution’s or clients’ portfolios within the next five years. This forecast indicates a continued acceleration in adoption over the next few years. Just over half (52%) of the institutions surveyed across Asia, Europe and the U.S. already invest in digital assets. Whilst adoption rates remain higher in Asia (71%) than in Europe and the U.S, participation increased in all markets as 56% of European institutions and 33% of U.S. institutions now hold digital asset investments, an increase from 45% and 27%, respectively in 2020. A more recent report published this year by the cryptocurrency exchange, Bitstamp, spoke to over 5,500 institutional investment decision makers as well as 23,113 retail investors from 23 countries spread across the world to understand their attitudes and ambitions for crypto, now and in the near future.

Institutional investors found regulation to be one of the top 3 concerns for those not currently investing in crypto. Risk and volatility were the top barrier for these investors, followed closely by the lack of regulation in the industry and the fact that, as they see it, crypto is still just too new. However, mainstream adoption is growing among retail users. According to a Federal Reserve study, published in May 2022 to measure the economic health of U.S consumers (which mentioned cryptocurrency for the first time), as many as twelve percent of American adults held cryptocurrency in 2021. The survey indicates a growing interest by the U.S. central bank in understanding how the crypto economy fits into the wider economic picture. Whilst some Wall Street institutions may still see crypto as too new, this suggests that an increasing number of ordinary investors (largely wealthier ones) are nevertheless willing to give it a go.

IMPLEMENTATION ACCELERATES

One of the biggest barriers to deeper convergence between TradFi and DeFi remains a lack of education and knowledge about all of the latest advancements in cryptocurrencies, blockchain, digital assets and tokenisation. Yet, in many places in the TradFi world, the initial scepticism towards cryptocurrency and blockchain has moved towards curiosity, which in turn has led to implementation, at least of pilots and proofs of concept. Those attempts at real-world implementation have themselves thrown up even more questions about where the gaps are in linking existing legacy systems with the new worlds of blockchain and digital assets. Developments such as providing robust custody for institutional investors is a case in point and is an area that has advanced significantly in the last 4 years with multiple providers now proving their worth. Likewise, nation states’ interest in Central Bank Digital Currencies and the multiple projects being conducted all over the world has advanced regulators’ knowledge and raised the profile of new forms of digital money (such as stablecoins) more broadly. Today, as a result of all these developments, we are rapidly starting to see more integration between traditional finance and decentralised finance. Wall Street banks are opening digital asset divisions and many leading executives are jumping ship from jobs in TradFi to start the next generation of crypto companies — be they new-style asset managers designed to deal specifically with digital assets or custodial networks that can handle post-trade in a digital world. Thanks to tireless work by technologists, there are also now more seamless bridges between centralised and decentralised financial systems as well as the creation of more interoperable products and services which allow them to work better together.

Convergence, of course, is not just about the joining up of traditional and decentralised finance ventures, but also about the concurrent emergence of multiple frontier technologies which are now coming together to create new forms of innovation. A few years ago, Outlier Ventures, one of the leading venture capital firms in the blockchain industry, created an investment thesis called ‘The Convergence Ecosystem’. In this vision, which is now already coming to pass, data would be captured by the Internet of Things, managed by blockchains, automated by AI, and incentivised using cryptocurrency or cryptographic tokens. This technological convergence will create many different financial products and services that we could simply not have had in the past, as we did not have the decentralised infrastructure to make value transfer on the internet viable. Now we do. And now that banks and traditional financial institutions have finally woken up to the value creation opportunities presented by blockchain and digital assets, the market is accelerating much faster.

It would seem that banks and other regulated financial services firms have realised the transformational potential of crypto and blockchain technology and like so many other aspects of our lives, they are embracing what seems like the inevitable march towards digitisation.

The era of convergence has arrived.